We have been going over budget for the past couple of months and falling short of our money goals. The reasons being…

- Inflation! Every time I go to the grocery store, things are more expensive than the last time!

- Our tracking system is no longer working for us.

Previously, we used a whiteboard in our kitchen to track our spending. It had worked well in the past.

But as our lives continue to get busier with school, soccer, and other activities, we forget to track expenses as we spend them. Which leads to overspending.

So, we decided to try the EveryDollar app to improve our budgeting process. And I have to tell you, I absolutely love it!

Being a Baby Steps follower, it fits our budgeting needs perfectly. I can’t believe we haven’t used it before this. But, I am a paper and pencil kind of gal, so I didn’t think I would like it.

Anyway, this budgeting app will be a game changer, helping us stay on budget and reach our monthly savings goals.

So, I would like to share how to use EveryDollar budget app because it’s my new favorite thing!

Disclaimer: This post may contain affiliate links. This means I receive a small commission, at no extra cost, if you purchase using the links below. Please see my earnings disclaimer for more details.

Table of Contents

Why budgeting is important

So you may be thinking, why do I need a budget?

Well, let me tell you!

A budget helps you make better financial decisions, changes your spending habits, and helps you achieve your financial goals.

Ultimately, it helps you take control of your money and improve your financial situation.

By creating budget categories important to your family, you can work to pay off credit card debt, save money, and build wealth.

But being on a budget just isn’t for people struggling financially.

Everybody can benefit from a budget because it allows you to spend guilt-free! A budget shouldn’t make you afraid to spend money, as long as you have it to spend!

What is the EveryDollar app?

EveryDollar is a budgeting tool made by Ramsey Solutions. It helps you create a monthly budget and track your spending to stay on budget.

The EveryDollar app uses the zero-based budgeting method, which is excellent for first-time and experienced budgeters.

It helps you create a personalized budget based on where you are in the baby steps, which allows you to set goals like debt payoff or save.

What is zero-based budgeting?

The zero-based budget is basically your income minus your expenses equal to zero.

Every dollar is assigned to a category. Budgeting this way forces you to give every dollar a place, so there is no money left floating around at the end of the month.

Even if you have to put it into savings to reach a total of zero, every dollar should have a home.

Why use the EveryDollar app?

There are a couple reasons you should use the EveryDollar budgeting app.

It will help you control your spending

The EveryDollar app allows you to create your personalized budget with a customizable template. You can add, delete, and change whatever you need to make your budget what you need it to be.

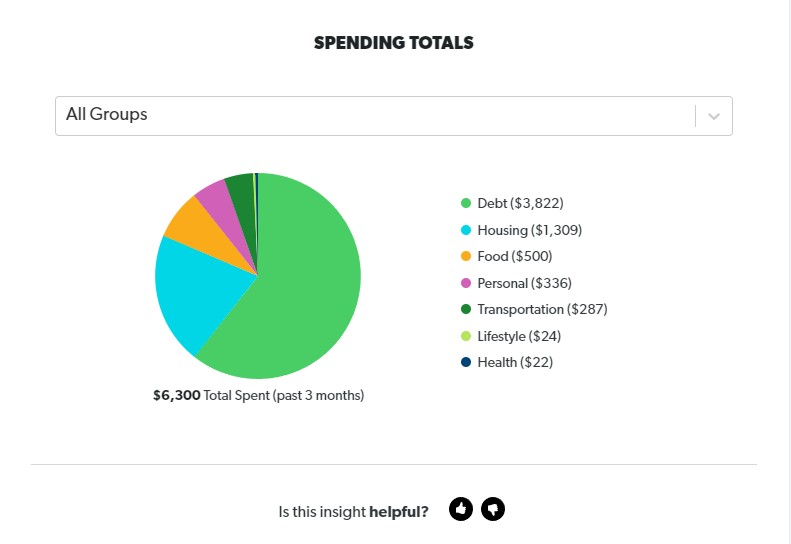

You see exactly what you have coming in and going out. Therefore, you get to see the real-time movement of your money. It shows you a breakdown of your spending and compares it to the recommended percentages in the different categories.

This is so helpful when making changes and cuts to our budget.

It will help you save money

The EveryDollar budgeting app helps you set money-saving goals and track your progress.

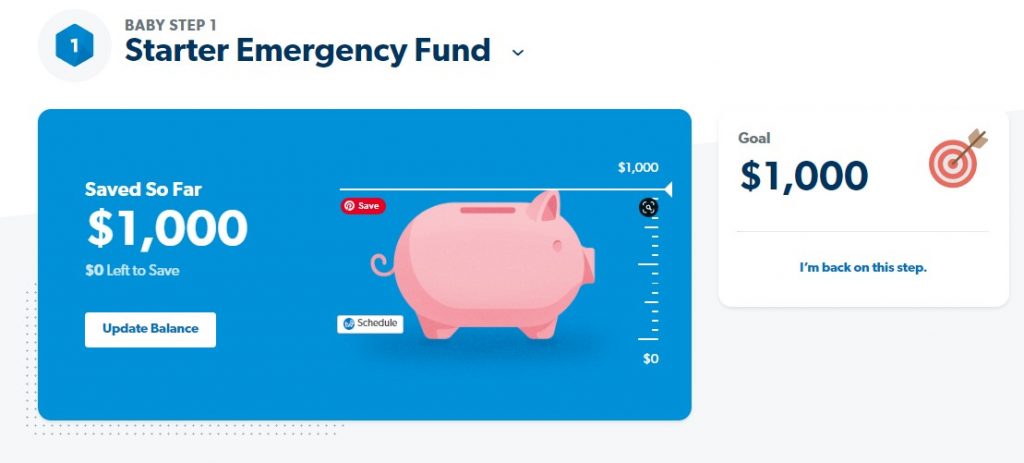

Since it’s based on Dave Ramsey’s Baby Steps, it has a specific category for saving accounts. Your starter emergency fund is first on the list.

You can add other saving funds as well. In fact, I set up a sinking fund for everything we are saving for. You can set fund details like your total savings goal, your current amount, and due dates.

This is such a great feature for us because we have our savings in a lump sum in one account. Therefore, we can keep it there and just organize the sinking funds in the app so we know exactly how much goes to each thing we’re saving for.

Related: Dave Ramsey’s 7 Life-Changing Financial Baby Steps

It will help you pay off debt quicker

I swear I could kick myself for not using this when we were paying off our debt.

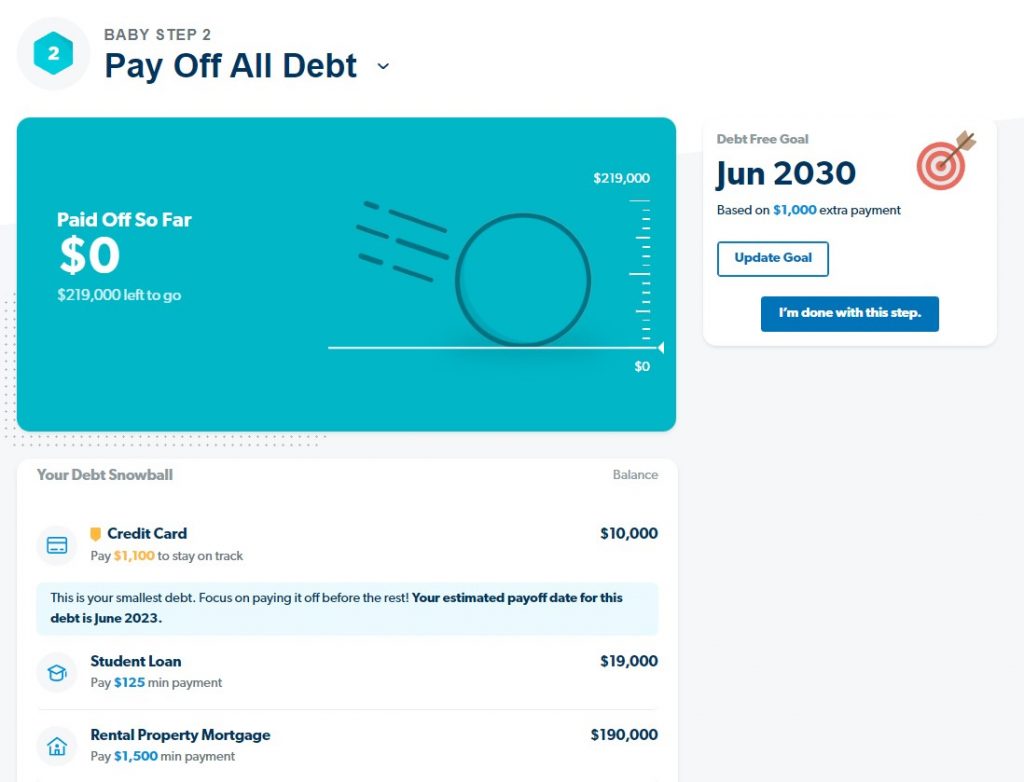

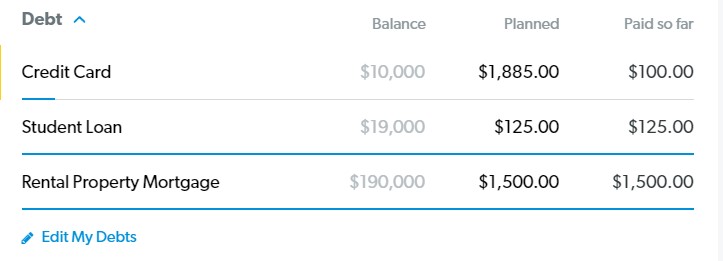

You input all your debts (lowest amount to highest) with the minimum payments and the amounts you owe. Then, you pay them according to the debt snowball method.

The really cool thing is that it shows you your progress in the baby steps tab. It lists the total number of debts and the amount you owe with a thermometer countdown to debt-free.

I love visual motivation tools. We used something similar when we were paying off our debt. It’s really helpful to have something to keep you motivated.

Related: How to Slay Your Debt Using the Debt Snowball

Is EveryDollar a good budgeting app?

I think the EveryDollar app is a fantastic tool to help you manage your money. I think it would be especially beneficial if you are following Dave Ramsey’s Baby Steps or using the zero-based budgeting method.

How to use EveryDollar Budget

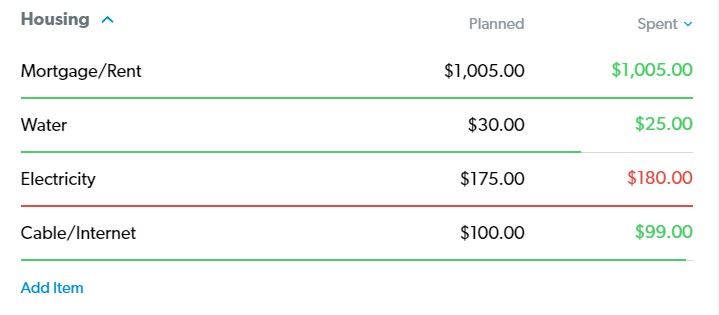

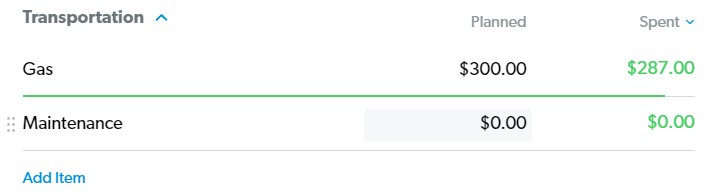

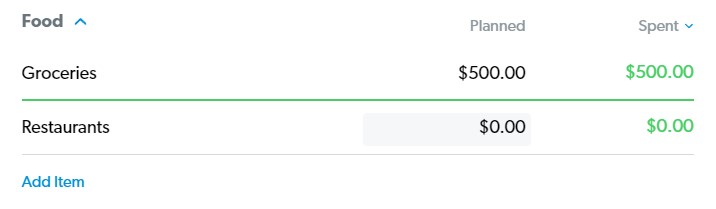

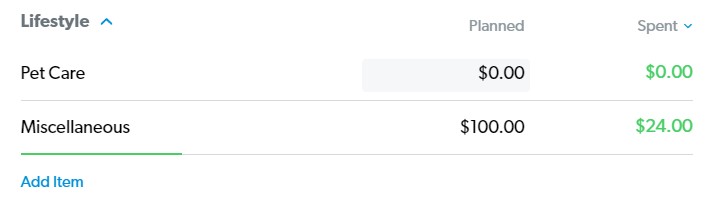

The EveryDollar app is user-friendly and super simple to use. There are three sections to the EveryDollar budget: planned, spent, and remaining.

Planned

The planned section is where you first create your monthly budget. You’ll want to do this before the month begins.

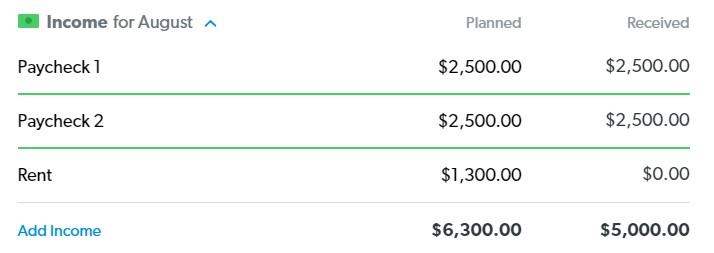

First, enter your expected income for the month. Then, fill out the planned expenses in all the categories you plan to spend.

When every dollar has its place, it’s an EveryDollar budget!

Make sure to include any yearly or irregular bills or subscriptions. I made a spreadsheet to keep track of the amount and month the payment is due.

I used one of our old budgets from when we were in debt in this post to show how EveryDollar works.

Spent

Next, you track your monthly income as it comes in and your expenses as they go out.

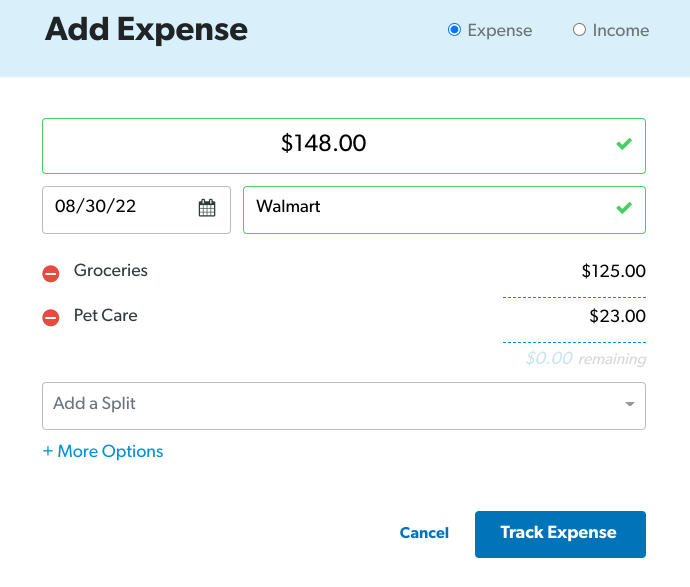

To do this, add a transaction and input the amount deposited or spent, the merchant, and the category the income or expense goes to.

You can include any notes you may want to add to keep you organized.

After you add the transaction, it automatically adjusts to show you how much you have left in your budget categories.

Remaining

Lastly, you’ll want to monitor your spending throughout the month to ensure you stay on budget.

There will be months you may go over, especially with gas and groceries as unpredictable as they are.

So, note the remaining balance at the end of the month, and make adjustments for the next month’s budget.

Monthly Expenses To Include In Your Budget

When creating your budget, there are two types of expenses: the essentials and the non-essentials.

The essentials

The essentials (or as Dave likes to call them, the four walls) are the things you can’t live without. These include:

- Housing and Utilities

- Transportation

- Food

- Clothing (the necessities)

When creating your monthly budget, it helps to start with budgeting the essentials. This will ensure the expenses you absolutely need will be covered.

The non-essentials

After the essentials are budgeted, you move on to the non-essential items. Even though some non-essential items include bills that need to be paid, they don’t fall into the absolutely essential to live category.

Therefore, you would prioritize them in order of importance. For example, credit cards, car payments, and student loans would come before streaming subscriptions and gym memberships.

By prioritizing all other expenses, you can figure out where to save and what to cut to make sure all your monthly expenses are covered.

Pros of EveryDollar

The pros of EveryDollar are:

- It’s really easy to get started.

- The interface is simple and user-friendly.

- It comes with a template that can be changed to meet your needs.

- You can keep track of your finances according to the Baby Steps.

- It copies the previous month’s budget, so you don’t have to create a new one each month.

- The paid version is affordable and has a wealth of resources to help you manage your finances.

- You can use the app or sign in on the computer to do your budgeting.

Cons of EveryDollar

The possible cons of Everydollar are:

- It may be too simple for some people with not enough budgeting functions.

- With the free version, manually entering the transactions is a bit time-consuming. But on the other hand, it really makes you think about your purchases so you can change your spending habits in the future.

Things to Remember When Making Your EveryDollar Budget

There are a couple things to remember when creating your EveryDollar Budget.

Budget every dollar

Make sure every dollar has a place within your budget. Enter your essentials first and then the non-essentials in order of priority.

If you have extra money left to budget, put it towards an emergency fund, debt, or sinking funds.

Be realistic

Keep your budget realistic, or you will not stick to it. Make sure to set a reasonable amount for each category you budget.

Don’t try to make budget cuts where you know you can’t. You’re setting yourself up for failure!

Just know that if you increase a budget category, it needs to come from somewhere else within your budget.

Make adjustments

Even though Everydollar carries over to the next month, add new categories as needed.

Also, adjust your budget based on your previous month’s spending by increasing or decreasing the amount allocated to each category.

How much is EveryDollar a month?

There are two versions of EveryDollar: a free version and a paid premium version. Let’s take a closer look at the bells and whistles of each.

The free version of EveryDollar

The free version of EveryDollar is all you need to start budgeting. It includes the ability to set up:

- Personalized budgets

- Saving accounts for your sinking funds

- Debt payment based on the debt snowball

The paid version of EveryDollar (EveryDollar Plus)

The premium version of EveryDollar has everything the free version does but with some extras. It’s $79.99 a year or $12.99 a month, including a 14-day free trial. Here’s what you can do with the paid version.

- Connect your bank account, eliminating the need to manually enter your transactions.

- One-click transaction tracking, which makes tracking much quicker.

- Income and spending charts, which show the percentages of your cash flow.

- Access to Financial Peace University.

- Access to other courses Ramsey Solutions offers, including Borrowed Future, Anxiety and Your Money, Smart Money Smart Kids, etc.

The paid version is definitely worth it if you want to learn more about managing your money. Financial Peace University was invaluable to my family, and I wholeheartedly recommend it!

Frequently asked questions about EveryDollar

Here are a few FAQs about using the EveryDollar budgeting app.

Can two people use EveryDollar?

Yes! It’s so important to be on the same page with your spouse about your finances. And this app will help you do that.

One of you needs to sign up and create an account. From there, you both log in using the same account information. You can both add transactions and see your cash flow in real-time.

Can you split transactions?

Sometimes we spend in multiple categories during one transaction. For example, I get my dog food from the grocery store. But, my dog food is under the pet care category and not included in our grocery budget.

In this instance, I would add a transaction like I usually do, putting in the amount I spent and choosing the grocery category. Then, I would click add a split and choose the other category, pet care.

Doing this allows me to input the whole transaction and just choose how much I spent for each category instead of having to add two separate transactions.

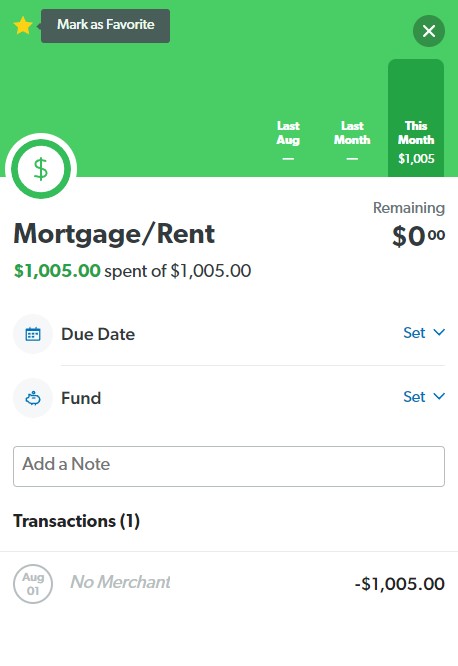

Can you add favorite categories?

You can add favorite categories, and it will bring them up to the top of the page under favorites. This is incredibly helpful for the budget items we pay monthly.

To add a category to your favorites, click on the line item and then toggle on the favorite button (or click the star using the website).

Can I access EveryDollar from my computer?

Even though the app is very convenient, EveryDollar is also offered in a desktop version. It may be easier for some people to enter transactions on a computer rather than on the mobile app.

Does EveryDollar Work?

Absolutely! The only reasons it may not work for you are:

- You don’t budget using a zero-based budget.

- You want a more complex budgeting system.

I would start using the free version first to see if you like it. That way, you have nothing to lose. Then, if you want to be able to link your bank account or access Financial Peace University, you can invest in it.

Conclusion

EveryDollar is an excellent app to help manage your finances. It’s simple and user-friendly.

I love how we can create a quick budget personalized to our needs and goals. It makes it much easier for my husband and me to track our overall spending and keep an eye on our remaining balances.

As I said, we needed to change our tracking system because we were overspending. The EveryDollar app is a complete game-changer for us!

Have you tried the EveryDollar app? Let me know what you think about it.

I use another App to manage my expenses but this seems a good option to try out!

I use Mint to track my finances. I like that it imports my transactions as I have a lot of accounts and it’s free. It sounds like the paid version of this one has a lot to offer. I did a post on making ends meet and reviewed a few other free apps too.